Insight

August 7, 2024

FTC PBM Study: Another 6(b) Report, Hold the Economists

Executive Summary

- In July, the Federal Trade Commission (FTC) released its interim staff report on the impact pharmacy benefit managers (PBMs) have on the accessibility and affordability of prescription drugs.

- The findings of this two-year-long investigation largely focused on the vertical integration and concentrated market structure of the industry and led the staff to conclude that PBMs “may be profiting by inflating drug costs and squeezing Main Street pharmacies.”

- Like the FTC’s grocery supply chain study released in March, the PBM report lacked sufficient research and quantitative analysis and failed to consider competitive and consumer effects; the study’s various deficiencies may lead the agency to pursue meritless enforcement actions that increase costs for consumers.

Introduction

The high cost of prescription drugs has long been a topic of political and economic concern. In June 2022, the Federal Trade Commission (FTC) announced that it would launch a 6(b) investigation – a section of the FTC Act allowing the agency to conduct industry studies that do not have a specific law enforcement purpose – into the role pharmacy benefit managers (PBMs) play in the access and affordability of prescription drugs.

After a two-year-long investigation, the FTC released its interim report in July 2024. The report largely focused on the vertical integration and concentrated market structure of the industry and concluded that these conditions “may” have enabled PBMs to “profit[] by inflating drug costs and squeezing Main Street pharmacies.”

Like the FTC’s grocery supply chain study released in March, the PBM study lacked sufficient research and quantitative analysis and failed to measure the competitive effects and the role they play in affecting the out-of-pocket costs to consumers. Using the FTC’s conclusions to craft policy could lead to warrantless enforcement actions that could result in increased costs for consumers.

Background on PBMs

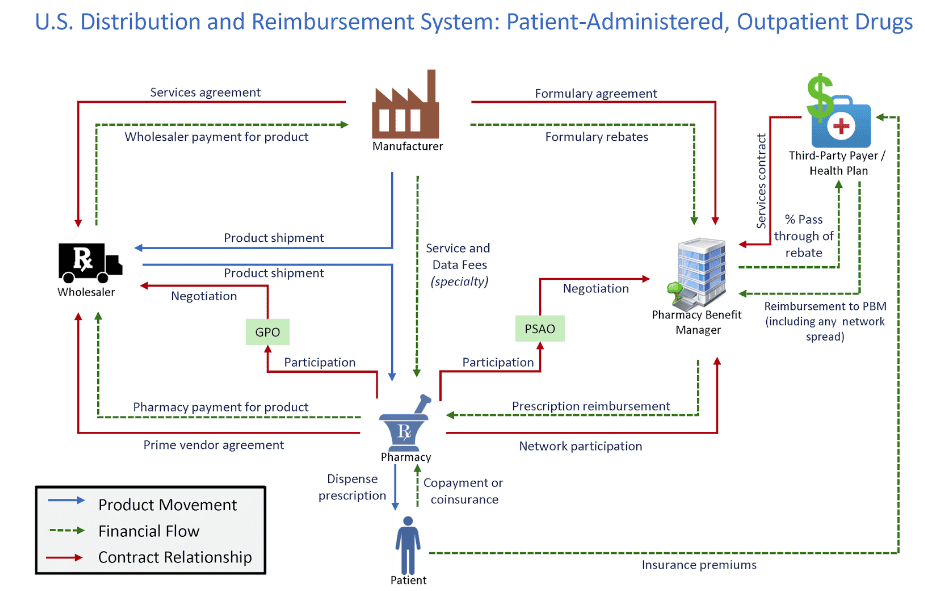

PBMs operate in an opaque part of what is a complex prescription drug supply chain. These firms act on behalf of health plans to manage patient drug utilization and process prescription drug claims. PBMs also offer other services including formulary design, price negotiations with manufacturers, creating a network of pharmacies, and operating their own mail order pharmacies.

Figure 1 shows the various and complex relationship PBMs have with the rest of the drug supply chain. The graphic includes the product movement, financial flow, and contract relationships in the health care system.

Figure 1

*Source: Drug Channels Institute

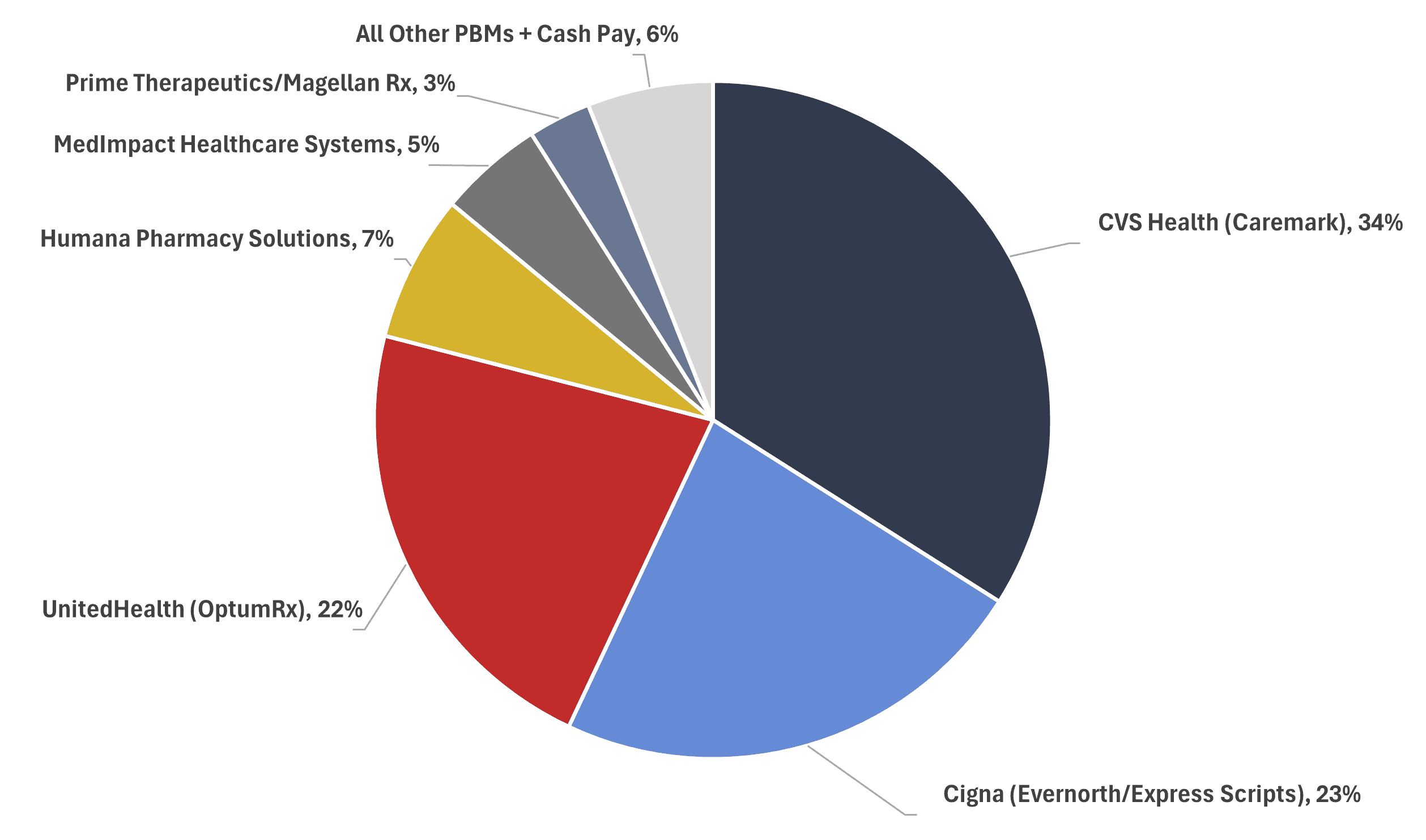

According to the interim report, the “top three PBMs processed nearly 80 percent of the approximately 6.6 billion prescriptions dispensed by U.S. pharmacies in 2023, while the top six PBMs processed more than 90 percent,” as can be seen in Figure 2. According to a footnote in the report, 66 PBMs currently operate in the United States.

Figure 2

PBM Market Share, by Total Equivalent Prescription Claims Managed, 2023

* Source data: Drug Channels Institute

FTC PBM Interim Staff Report

Following a two-year-long investigation, the FTC released its PBM interim staff report in July 2024. After reviewing more than 1,200 public comments, interviewing industry expects, and examining public and private data, the FTC concluded that “amidst increasing vertical integration and concentration,” PBMs “may be profiting by inflating drug costs and squeezing Main Street [independent] pharmacies.”

During its fact-finding mission, the FTC sent compulsory orders to the six largest PBMs – CVS Caremark, Express Scripts, OptumRX, Humana, Prime Therapeutics, and MedImpact Healthcare Systems – seeking information on fees, pharmacy reimbursement methods, rebates, formulary design, and other business practices. Months later, the FTC issued additional orders to Zinc Health Services, Ascent Health Services, and Emisar Pharma Services.

The FTC voted 4-1 to allow staff to issue the interim report. Chair Lina Khan, joined by Commissioners Rebecca Kelly Slaughter, Alvero Bedoya, and Andrew N. Ferguson, voted in favor while Commissioner Melissa Holyoak dissented, citing concerns over the report’s lack of “substance” and economic rigor and its failure to provide “a better understanding of the competition concerns surrounding PBMs or how consumers are impacted by PBM practices.” Though Commissioner Ferguson voted with the majority to release the report, he issued a separate concurring statement in which he voiced several concerns similar to those of Commissioner Holyoak.

The purpose of the report, as former Commissioners Noah Phillips and Christine Wilson contend, was to “allow the FTC to update the findings of the 2005 study” that investigated the competitive effects of PBMs’ ownership of mail-order pharmacies, under the rationale that markets have since evolved. Curiously, a year before the interim study was released, the FTC discounted prior guidance on PBMs, claiming they “no longer reflect current market realities.” Such action suggests the results of the interim report may have been predetermined. In fact, the 2005 PBM report now features a caution label stating that “This material is for reference only.”

The interim report made several claims:

- Concentration and vertical integration: The FTC found that horizontal consolidation and vertical integration has created an industry where the top three PBMs processed nearly 80 percent of prescription drugs; the top six processed more than 90 percent. Furthermore, the top six are vertically integrated, operating their own mail-order or specialty pharmacies. Five of the top six are now part of health insurance companies.

- Access and prices of drugs: Vertical integration and concentration allow PBMs to “exercise significant control over which drugs are available, at what prices, and at which pharmacies.”

- Incentive for self-preferencing: Vertical integration creates the incentive for PBMs to use their own pharmacies rather than unaffiliated pharmacies.

- Contract terms: Increased concentration provides PBMs with the leverage to disadvantage smaller, unaffiliated pharmacies.

- Limit access to low-cost drugs: PBMs and brand pharmaceutical manufacturers often agree to exclude generic drugs and biosimilar from formularies in exchange for higher rebates from manufacturers, which may “cut off” patient access to lower-cost drugs.

These claims were largely not substantiated using a rigorous economic analysis of the data supplied by the PBMs. Instead, as Commissioner Ferguson wrote in his concurring statement, the report “relie[d], throughout, in large part on public information…[and] public comments.”

Where Are the Economists?

The FTC’s interim PBM report featured shortcomings similar to the grocery store supply chain study released in March and previously covered in American Action Forum insights. Mainly, the interim report lacked quantitative analysis that is customary in 6(b) studies and failed to answer even the most basic questions related to the competitive dynamics of the industry and the effect on consumer costs, despite having troves of data provided by the PBMs.

Commissioner Holyoak summarized several of these deficiencies, arguing that “perhaps most troubling is the Report’s failure to examine how PBM practices affect consumer prices.” She added that “though the Report baldly asserts that PBMs ‘have gained significant power over prescription drug access and prices,’ the Report does not present empirical evidence that demonstrates PBMs have market power—i.e., ‘the ability to raise price profitably by restricting output.’”

The exclusion of such an analysis makes it difficult to discern the affect PBMs have on out-of-pocket costs for consumers. It raises the question – where were the economists? This study added to the mounting pile of evidence suggesting the weight placed on rigorous economic analysis at the FTC has waned.

A specific example can be found in Section III Part B of the report, which focused on revenue received by PBM-affiliated pharmacies for specialty generics. The FTC claimed that these pharmacies pay PBMs higher reimbursement rates for specialty drugs compared to unaffiliated pharmacies. The evidence to support this claim relied on just two case studies. As Commissioner Ferguson explained, “the case studies are illuminating, but hardly definitive,” and stated that the FTC needs to “determine whether these findings are representative of market dynamics for other drugs, and we need to learn whether any reimbursement practices ultimately affect consumers’ out-of-pocket costs.”

Ferguson also noted that rather than using quantitative analysis to substantiate the various claims condemning PBMs, the report “relie[d], throughout, in large part on public information…[and] public comments,” many of which were submitted anonymously. He also warned against the agency’s reliance on comments submitted by companies with contractual relationships with PBMs, stating that these companies “may have an incentive to instigate regulatory action against PBMs to improve their bargaining position.”

Commissioner Holyoak’s concerns were not limited to the lack of empirical evidence or the scope of the report. She was also concerned with what it meant for the agency’s future. In her dissent, she explained the history of 6(b) studies and how “these reports have provided Congress and the public with evidence-based, objective, and economically sound information that can shape the national debate,” noting that “the standard of these reports has been nothing short of excellence.” She concluded, however, that the PBM report “fail[ed] to meet that rigorous standard,” and that the report “will only exacerbate ideological schisms and further degrade the legitimacy of the Commission.”

Given the glaring omissions of economic evidence and the complexities of the prescription drug supply chains, it is difficult to draw any conclusions with respect to the role PBMs play in the out-of-pocket costs consumers pay. The study is simply incomplete. Moreover, Congress should be wary of using the conclusions found in the study to draft legislation.

What Could Have Been

The interim staff report is another missed opportunity by the FTC to contribute to the public debate over the role PBMs play in the cost and availability of prescription drugs. Moreover, this report seemingly contradicts several economic studies on the role PBMs play in drug prices, including the 2005 FTC report.

Recently, former Chief Economist at the Department of Justice Antitrust Division Dennis Carlton published a study analyzing the competitive dynamics of the PBM industry and drug prices. The report used data provided by the three largest PBMs, including data provided to the FTC for its interim report. Carlton concluded that PBMs lower drug costs for plan sponsors and members. Another study from 2022 by Casey Mulligan of the University of Chicago found that PBMs added $145 billion in value beyond their resource costs. A study from the Government Accountability Office (GAO) specific to Medicare Part D yielded a similar conclusion, finding that drug rebates negotiated by PBMs “offset Part D spending by 20% from $145 billion to $116 billion.” The study showed that PBMs negotiated $18 billion in rebates from Part D-participating manufacturers while retaining less than 1 percent of the rebates.

Armed with industry data, the FTC had the opportunity to conduct a similarly rigorous study as did Carlton, Mulligan, and the GAO. Yet the FTC interim report made weak claims using anecdotal evidence and research that failed to meet the typical agency standard.

Conclusion

After a two-year-long investigation, the FTC released its interim staff report on the impact PBMs have on the accessibility and affordability of prescription drugs. The findings largely focused on the vertical integration and concentrated market structure of the industry, which led the staff to conclude that PBMs may be profiting by inflating drug costs and squeezing Main Street pharmacies.

The interim report lacked the economic rigor and a focus on competition that is typical of FTC 6(b) studies. A future final report will need to contain more empirical evidence of competitive effects and the role PBMs play in affecting the out-of-pocket costs to consumers. Congress should be wary of using the conclusions drawn in the study to draft legislation and the FTC should similarly guard against conducting enforcement actions using the incomplete and unsubstantiated claims made in the report. Action based on these findings risks raising prices for the consumer.