The Daily Dish

February 5, 2024

The Most Important Labor Data This Past Week

Now, of course, you are expecting Eakinomics to highlight the Friday employment report, which featured 353,000 new jobs (Eakinomics was expecting 100,000) and year-over-year growth in average hourly earnings of 4.6 percent (Eakinomics was at 3.9 percent). Yes, hot, hot, hot. But most important? Not, not, not.

The most important data was released the day before when the Bureau of Labor Statistics (BLS) announced that non-farm labor productivity grew at an annual rate of 3.2 percent in the 4th quarter. That was well above expectations and finished a year of strong productivity growth.

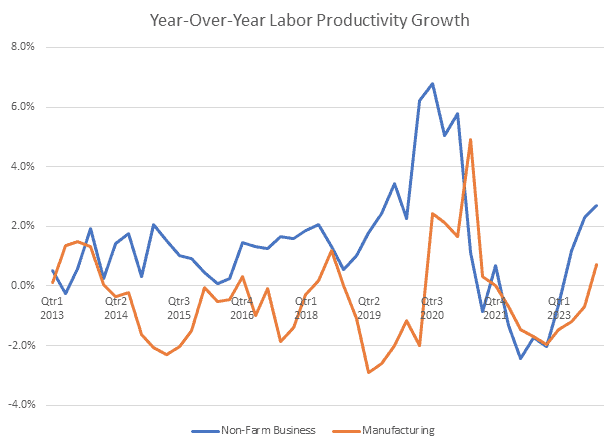

Indeed, 2023 was an extraordinary year. Year-over-year productivity growth was well above pre-pandemic norms (see chart, below) at 2.7 percent. But the recovery from four quarters earlier – 4.7 percentage points – was the largest one-year swing in the past decade.

Rapid productivity growth was a big reason that 2023 was a year of strong job growth and relatively painless disinflation. On average, the labor market created 255,000 jobs each month in 2023. But the presence of 2.7 percent productivity growth is the equivalent of adding an additional 354,000 workers every month. In short, it is a huge increase in the effective labor supply, which allowed growth in output and employment even as Federal Reserve restraint slowed the pace of inflation.

As the graph makes abundantly clear, productivity growth is notoriously volatile. So, looking forward to 2024, one downside risk is the disappearance of rapid productivity growth, raising the difficulty of reaching the 2 percent inflation target.

Fact of the Day

The January U-6 (the broadest measure of unemployment) stood at 7.2 percent, which reflecting revisions, is essentially unchanged.