The Daily Dish

June 10, 2022

May CPI Data

Today at 8:30 the Bureau of Labor Statistics will release the May 2022 data for the Consumer Price Index (CPI). The overall CPI rose at a year-over-year rate of 8.5 percent in March but declined modestly to 8.3 percent in April. Has inflation peaked in the United States?

There are some other data points that support this notion. The Federal Reserve’s preferred measure of inflation – the market-based price index for personal consumption expenditure excluding food and energy – hit a recent peak of 5.2 percent in March and fell to 4.9 percent in April. Similarly, the Producer Price Index (PPI) for both final and intermediate producer goods showed the same modest reduction in inflation. The sole exception is the PPI for commodities, which remained on the rise.

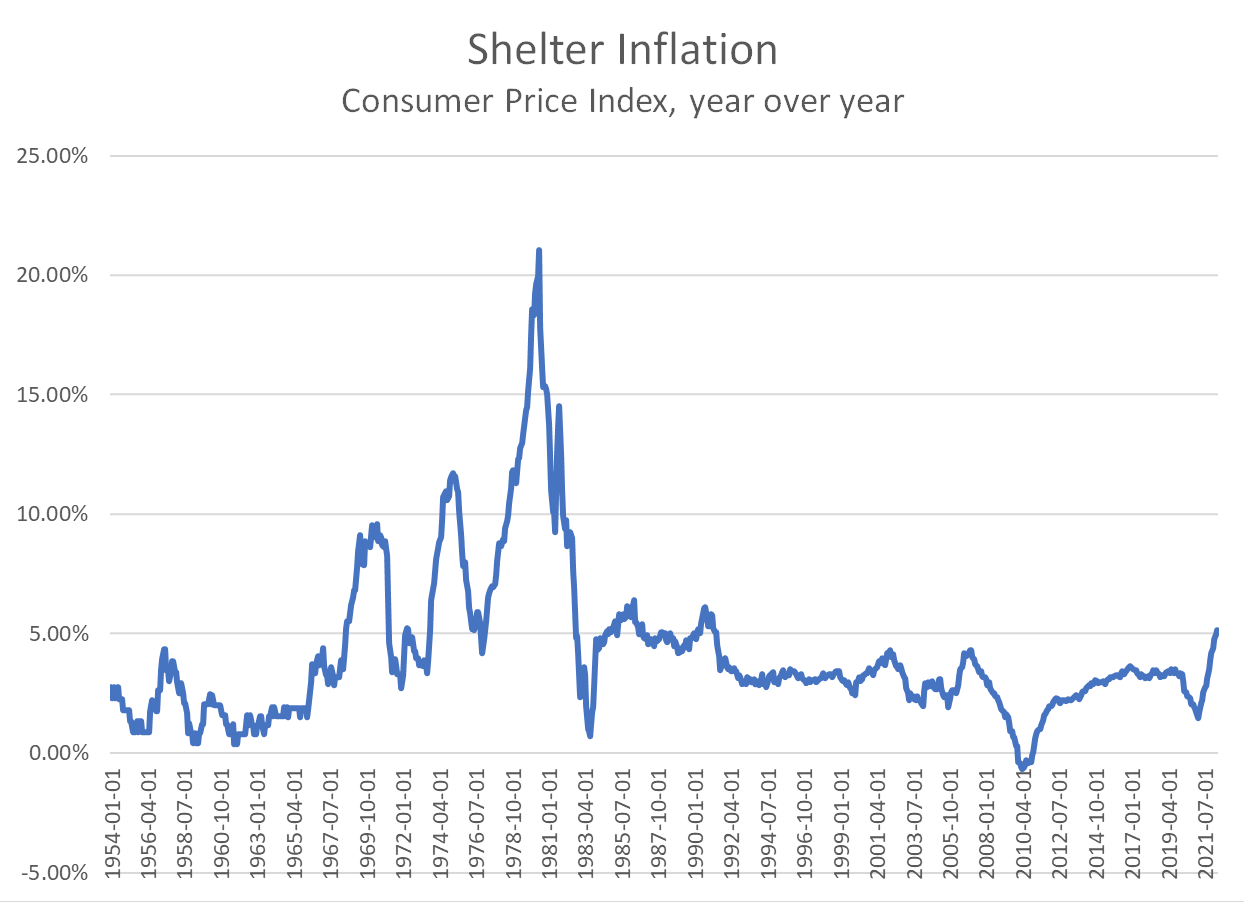

Eakinomics has no idea what the precise outcome will be, but its focus is on the inflation for shelter services (owned homes and rental units). Shelter inflation (shown below) is roughly one-third of the CPI and has shown no sign of peaking yet. More important, it is not a type of inflation that is prone to sharp, erratic reversals.

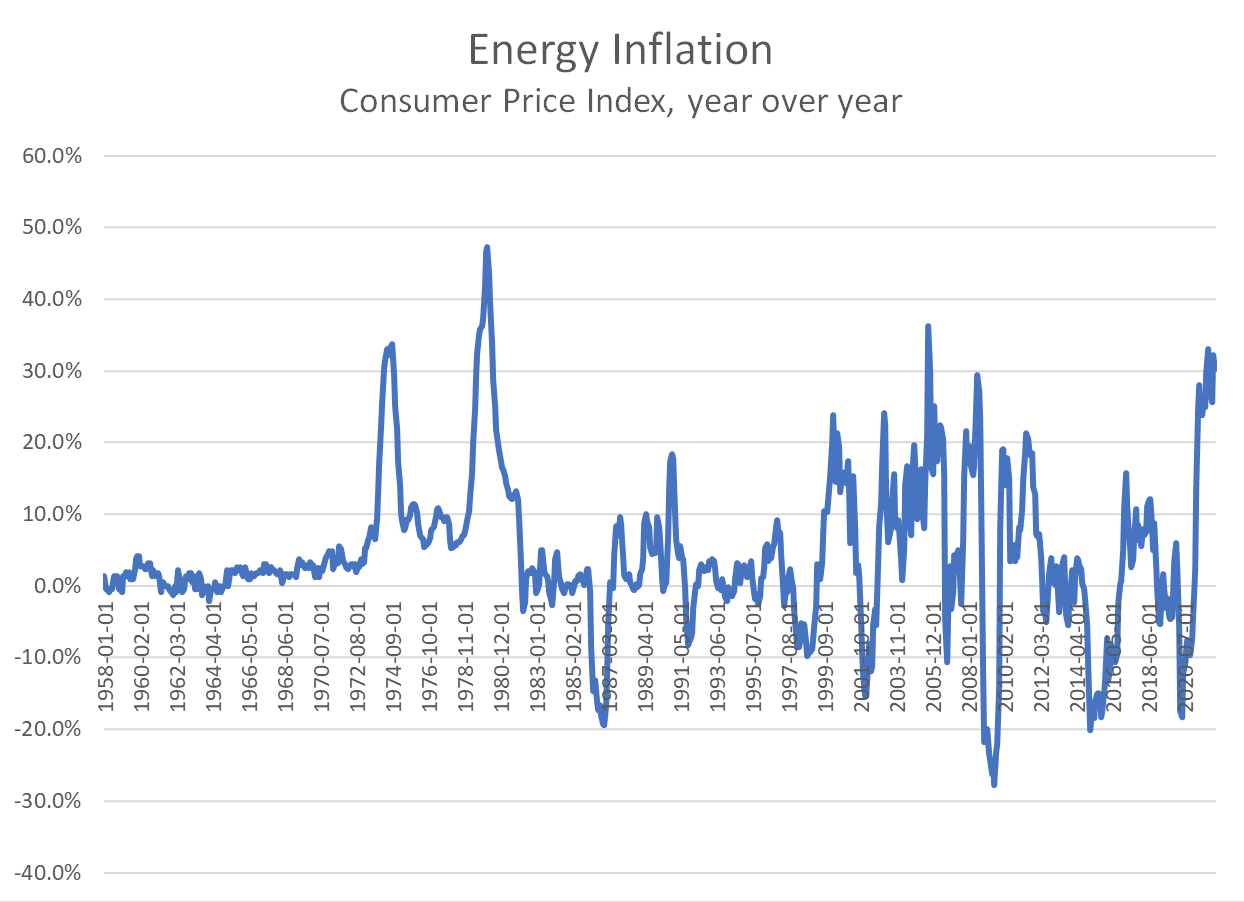

In the charts below, contrast shelter inflation with the corresponding inflation for energy services in the CPI.

The difference is striking.

The second key aspect of the shelter series is that where there have been significant disinflations, they have come in the immediate aftermath of recessions in the United States. Put differently, one cannot expect shelter inflation to simply dissipate. It will be the result of strong policy actions, with the risk that those actions contribute to future recession risks.

Today the focus is on shelter inflation. Recall that if it remains above 5 percent all other inflation has to fall at least to zero for the Federal Reserve to hit is 2 percent target. Shelter inflation has hit 5.1 percent with no sign of peaking. It is a good indicator of the difficulty of the Fed’s task.

Fact of the Day

Since January 1, the federal government has published rules that imposed $88.8 billion in total net costs and 49.9 million hours of net annual paperwork burden increases.