Weekly Checkup

May 28, 2015

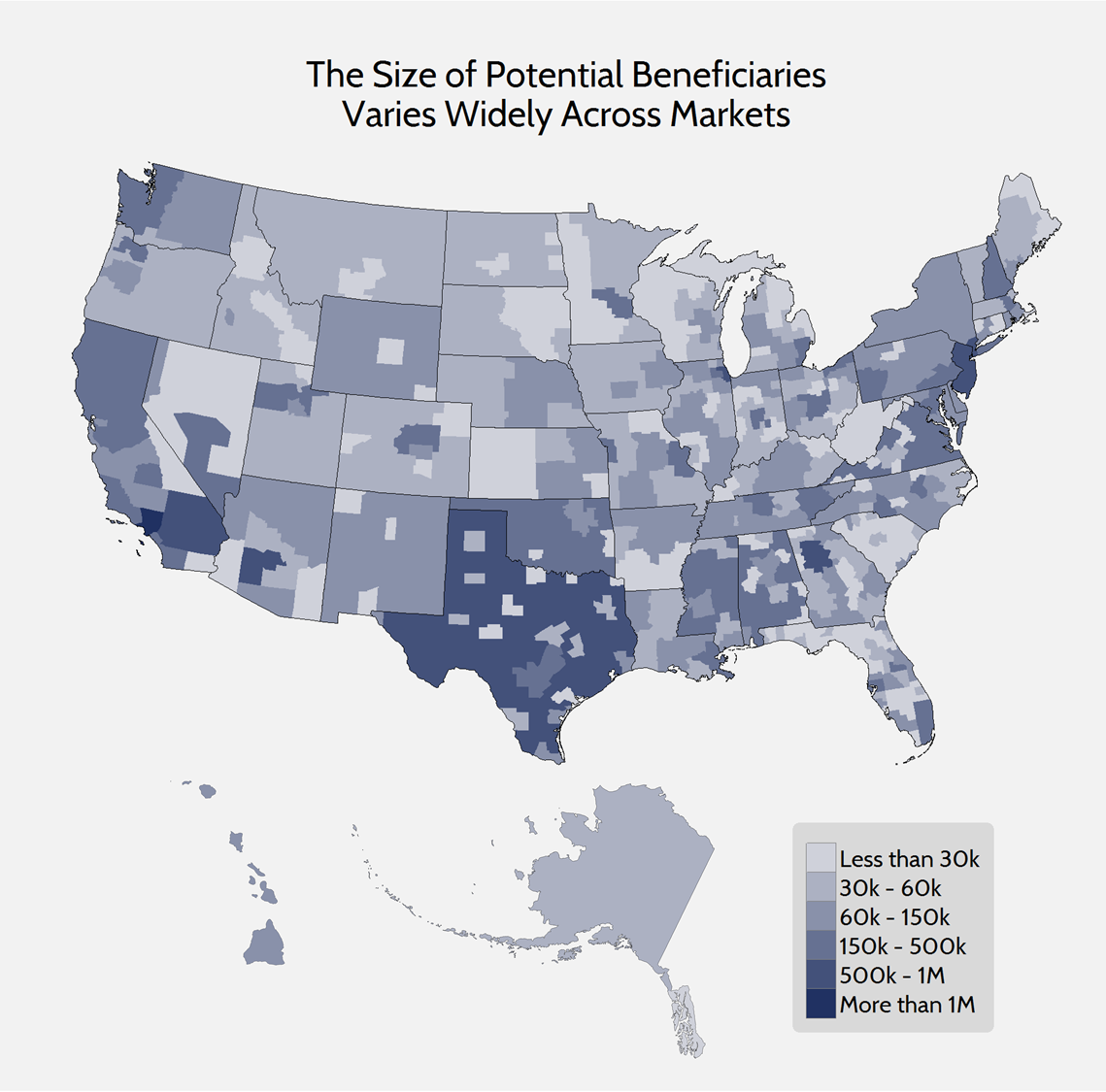

ACA Market Size May Influence Premium Volatility

The Health Insurance Marketplaces implemented by the Affordable Care Act (ACA) are broken into small geographic markets. Within these “rating areas,” an insurance company must sell a particular policy to all eligible individuals at the same age-rated price, regardless of medical history.[1] In order to account for geographic variation in health care costs, insurance issuers are free to set different prices for different rating areas. Additionally, the overall health status of the local population can have an effect on premiums. If one rating area uses more health care services than a neighboring area, the insurance company can raise the premiums on all beneficiaries living in the high-utilization area.

These rating areas are not uniform in size, leaving some areas more susceptible than others to premium changes. For example, rating areas with low beneficiary populations are less able to absorb the costs resulting from aging demographics. These areas are also less likely to be able to support insurance competition, which may also drive higher premiums. A typical rating area has roughly 60 thousand potential beneficiaries, but as the map below demonstrates, the populations vary widely.[2]