Research

July 12, 2017

Putting Nuclear Regulatory Costs in Context

Executive Summary

Nuclear power is among the safest, but also the most regulated forms of energy in world. As measured by harmful emissions, workplace injuries or fatalities on the job, nuclear has a sterling safety record, but the regulation imposed on the industry generates incredible costs and deters new reactors from producing zero-carbon energy.

Based on a review of publicly available 10-Ks, the American Action Forum (AAF) found $15.7 billion in regulatory liabilities for the industry, or $219 million per plant. These were largely related to long-term costs associated with disposing of waste. Annual ongoing regulatory costs range from $7.4 million to $15.5 million per plant, mostly related to paperwork compliance. Combined with regulatory capital expenditures and fees paid to the federal government, the average nuclear plant must bear a regulatory burden of $60 million annually.

These figures have profound implications for the industry’s bottom-line. Based on a review of per-plant profitability, there are at least six plants nationwide where regulatory burdens exceed profit margins. In total, AAF found 15 plants where regulatory burdens would exceed the nominal corporate tax rate in the nation. There is little doubt regulatory costs are one factor contributing to the retirement of nuclear facilities across the nation.

Finally, despite new nuclear reactor designs being safer, reactor design approval times still take several years, and these delays cost money and discourage new plants from ever being built. Regulators appear to regulate based on the risk of disaster from the 1970s, not 2017. AAF recommends a focus on one of the most significant regulatory liabilities of nuclear power plants: nuclear waste management. Mitigating the pecuniary and risk exposure of waste management, along with aligning regulation with the (low) risk generated by nuclear facilities will help to make the power source competitive once again.

Introduction

Last year, AAF found that the average nuclear power plant must pay at least $8.6 million in regulatory costs and $22 million in fees to the Nuclear Regulatory Commission (NRC). That research focused exclusively on the administrative costs of producing nuclear power, mainly the paperwork and fees required by NRC, in addition to security support.

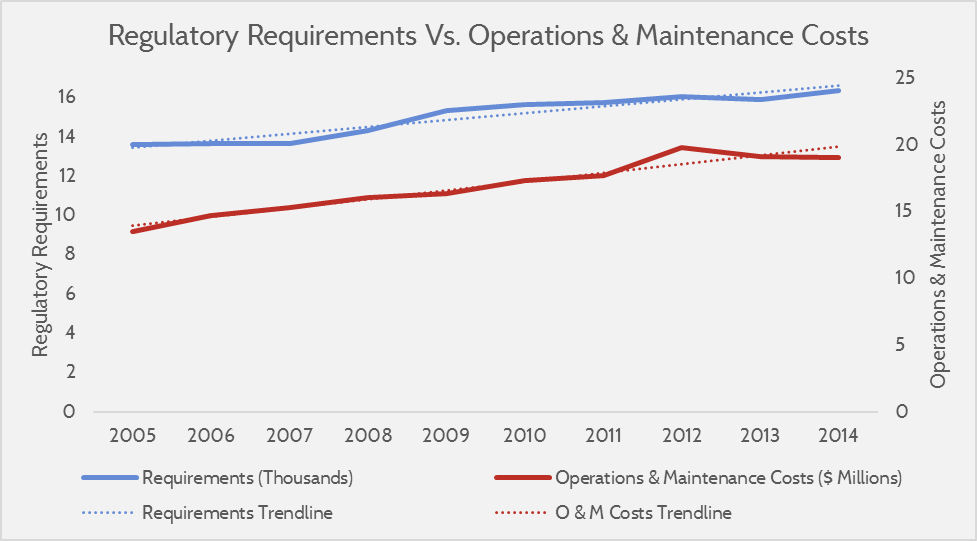

Based on a review of publicly reported 10-K data, AAF finds the average nuclear reactor must navigate $219 million in regulatory liabilities ($60 million annually per plant), with many of the newest burdens arising in 2012. In that year, operation and maintenance costs, and fuel liabilities spiked dramatically. Using the Mercatus Center’s RegData tool, AAF found the number of regulatory restrictions from NRC correlates almost perfectly with rising operation and maintenance costs (as reported by the Energy Information Administration).

Broadly, nuclear regulation is at a crossroads. Plants are shutting down faster than they are being constructed, and unlike other industries, nuclear is forced to subsidize its regulator (NRC); the industry also faces a permit approval and construction timeline that stretches more than 20 years. For comparison, other nations manage to license new reactors at a much quicker pace, and non-nuclear energy industries take advantage of generous subsidies and construction timelines of two to three years. Unlike other industries, however, nuclear is among the safest of power generation sources and carries the additional benefit of producing virtually no pollution.

Reforming nuclear regulation could generate tremendous benefits for the nation’s energy security, as it currently boasts the highest capacity factor of any dispatchable technology. However, reforming NRC’s fee and permit process is crucial to reviving nuclear’s promise as a fuel source. Aligning the approval process with other developed nations while building a consensus on advanced reactors could lower the costs of nuclear power and ensure the technology thrives as a baseload generation option for the nation.

Regulatory Costs

As noted, previous AAF research focused exclusively on the reporting, recordkeeping, and security costs of nuclear facilities. In addition to those expenses, facilities had to pay NRC an average of $22 million annually. However, after a review of publicly disclosed 10-K reports to the Securities and Exchange Commission (SEC), the actual figure is far higher. Based on a review of 13 companies that operate nuclear facilities, the total reported cost topped $15.7 billion, with a per plant average cost of $219 million.

The table below displays the reported total “regulatory liabilities” for nuclear reactors. The caveat is all of this data is self-reported. Thus, some companies that operate reactors reported no regulatory liabilities. Other companies reported more than $8 billion in costs.

| Company | Regulatory Liability | Description |

| Duke Energy | $8.1 billion | “Decommissioning Costs” |

| Exelon Corporation | $2.6 billion | “Nuclear decommissioning” |

| Edison International | $1.6 billion | “Recoveries in excess of ARO liabilities” |

| American Electric Power | $775 million | “Decommissioning” and “Spent Nuclear Fuel” |

| Entergy Corporation | $735 million | “Nuclear decommissioning trust funds” |

| PG&E Corporation | $626 million | “Recoveries in excess of AROs” |

| NRG Energy | $626 million | “Nuclear decommissioning trust liability” |

| FirstEnergy | $304 million | “Decommissioning and spent fuel disposal costs” |

| Ameren Corporation | $162 million | “Recoverable or refundable removal costs for AROs” |

| Pinnacle West | $71 million | “Spent nuclear fuel” |

| Westar Energy | $34 million | “Nuclear decommissioning” |

| DTE Energy | $27 million | “Expenses related to Fermi 2 refueling outage” |

| Oglethorpe Power | $11 million | “Asset retirement obligations – Nuclear” |

| Total | $15.7 billion |

These figures can largely be thought of as net present value costs to the industry. They revolve mostly around decommissioning and spent nuclear fuel costs. Although $8.1 billion is a significant sum to spend on regulatory compliance for Duke Energy, these are not costs in a single year, but likely reflect the liabilities for the lifetime of its nuclear fleet. Regardless, the scale of $15.7 billion in reported regulatory liabilities dwarfs the $8.6 million annual paperwork cost per facility.

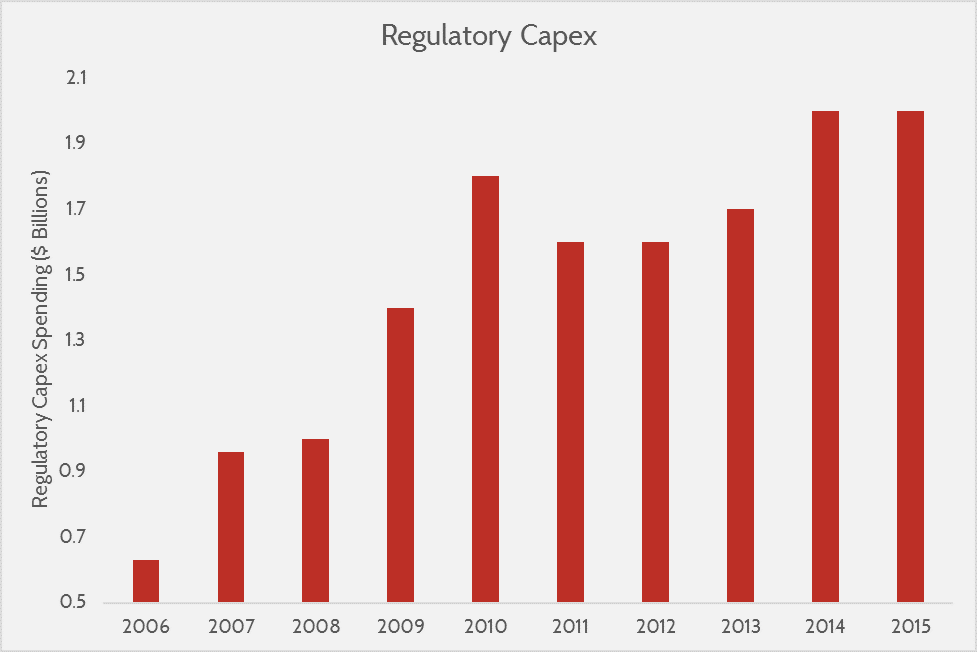

In addition to 10-K data, the Electric Utility Cost Group and the Nuclear Energy Institute (NEI) have complied data on capital expenditures (capex) within the industry. This includes uprates, extended operations, equipment replacement, and regulatory spending. Based on this data, regulatory capex has more than tripled from 2006 to 2015, from $629 million annually to $2 billion. This is by far the fastest-growing category of capex in the surveys. Because the number of nuclear plants has declined since 2006, the cost per plant has also increased by more than 340 percent. How many industries can withstand a 3.4-fold increase in regulatory costs in just one decade? On a per plant basis, this equates to $9.6 million in 2006, to more than $32.7 million in 2015.

The graphs below illustrate these notable trends:

Source: Nuclear Energy Institute

Not only are regulatory expenditures increasing, but the ratio to overall capex is also rising. For instance, in 2008, regulatory capex comprised 18.8 percent of overall capex. By 2010, regulatory spending increased to 24 percent of total capex. In 2015, the most recent year data are available, the percentage of regulatory spending has climbed to 32 percent of total nuclear capex, as much as any other category, only narrowly trailing equipment replacement (33 percent). Total capex in the industry has actually declined from $7.3 billion in 2010, to $6.3 billion in 2015, but regulatory costs continue to escalate.

Exclusive of these capex costs are the ongoing regulatory costs, largely dealing with NRC and compliance with safety requirements. One utility privately reported annual regulatory costs for nuclear compliance ranging from $12.5 million to $15.5 million for a dual unit (one plant with two reactors); for single units, this figure drops to $7.4 million to $8.9 million, which represents an annual range over four years of observation. Notice, the latter figures correspond almost perfectly with AAF’s estimate of $8.6 million per plant. Thus, combined with fees and capex spending per facility, the high-end of regulatory costs likely approaches $60 million in annual expenditures (assuming $20 million in fees, $30 million in capex and $10 million in regulatory compliance). Given the 61 plants in commercial operation, that equates to an annual ongoing burden for the industry of $3.6 billion (including fees, compliance, and capex).

What do these figures mean for the average nuclear facility? Profitability and loss vary widely between companies and plants; a report from the Congressional Research Service (CRS) attempted to determine profit per megawatt hour. They calculated the sales revenue for each plant and subtracted fuel, operation, and maintenance costs. CRS then derived a figure of dollars per megawatt hour per plant, ranging from 17.10 to -8.43. With this data, AAF examined megawatt hour sales of these plants to determine a net profit per plant.

The table below displays the net profitability per plant. It also assumes a low-end estimate of $30 million in regulatory costs per facility, half of what is projected above. To some extent, operation and maintenance costs will capture regulatory burdens, but they won’t represent NRC fees and they likely exclude capex spending. Assuming $30 million, here is the percentage of profits that regulation takes (“Regulatory Tax”) from the profitable power plants in the CRS sample:

| Plant | Profitability | Regulatory Tax |

| James Fitzpatrick | $2.3 million | 1,287 percent |

| South Texas Project | $5.1 million | 581 percent |

| Point Beach | $9.5 million | 314 percent |

| Comanche Peak | $12.2 million | 244 percent |

| Nine Mile Point | $20.4 million | 147 percent |

| Oyster Creek | $25.7 million | 116 percent |

| Three Mile Island | $31.4 million | 95 percent |

| R.E. Ginna | $34.4 million | 87 percent |

| Davis Besse | $43.5 million | 69 percent |

| Grand Gulf | $46.9 million | 64 percent |

| Braidwood | $55.9 million | 54 percent |

| Dresden | $59.4 million | 50 percent |

| Pilgrim | $63.9 million | 47 percent |

| Perry | $70.9 million | 42 percent |

| Seabrook | $71.6 million | 42 percent |

| Beaver Valley | $77 million | 39 percent |

| Indian Point 3 | $79 million | 38 percent |

| Hope Creek | $83 million | 36 percent |

| LaSalle | $88.8 million | 34 percent |

| Indian Point 2 | $102 million | 29 percent |

| Salem | $140 million | 21 percent |

| Peach Bottom | $161 million | 19 percent |

| PPL Susquehanna | $164 million | 18 percent |

| Limerick | $173 million | 17 percent |

| Calvert Cliffs | $245 million | 12 percent |

| Millstone | $253 million | 12 percent |

Notice that for six plants, $30 million in regulatory costs would exceed their profitability. For 15 plants on the list, the regulatory costs as a percentage of profitability would exceed the U.S. corporate income tax. Again, some regulatory costs are built into the operation, maintenance, and fuel costs, but even assuming $20 million in regulatory burdens would make five of these plants unprofitable. The power plant owners know the regulatory obstacles and profitability implications better than anyone, so if they remain open, there is likely a good reason. On the other hand, there is a reason nuclear plants are closing across the country.

It should be no surprise that Oyster Creek (116 percent) and Pilgrim (47 percent) are set to close in 2019 and politicians are hoping to bail out the Fitzpatrick (1,287 percent), Nine Mile Point (147 percent), R.E. Ginna (87 percent), Davis Besse (69 percent), and Beaver Valley (39 percent) plants.

These regulatory costs, $15.7 billion in total reported spending, $2 billion in annual capex, and $60 million in combined annual costs per plant, don’t just exist in a vacuum. They translate to higher costs for utilities, and ultimately for consumers. Thanks to the Energy Information Administration (EIA), there are annual figures for operation, maintenance, and fuel costs for each generation category. Not surprisingly, operation costs have increased by 50 percent from 2005 to 2014; this compares to a 41 percent increase in the fossil steam category and a decrease in operation costs for gas turbines. Likewise, maintenance costs have risen 26.5 percent, while fuel costs have accelerated by 66 percent during this period. The fossil steam industry has seen fuel prices increase, according to EIA, but only by 35 percent.

Broadly, total operation and maintenance costs have increased 41 percent from 2005 to 2014, but one year in particular warrants scrutiny: 2012. Across the examined period, the largest spikes, by far, occurred in 2012:

- Operation costs rose 15 percent;

- Maintenance costs increased 8 percent;

- Fuel costs accelerated by 9 percent.

Was there an identifiable regulation in 2012 that might have caused, or at least partially contributed to, these notable increases? Yes, in March of that year the NRC finalized three notable regulations requiring: 1) additional emergency equipment and pumps, 2) enhanced equipment to monitor spent nuclear fuel, and 3) improved emergency venting systems. There is little doubt these rules increased costs at nuclear facilities, but there is other empirical data that offer support for this conclusion.

One study, based on a survey from Platts, put a price-tag on these rules: $3.6 billion, or roughly $55.3 million per plant. These are costs that are either passed onto consumers in the form of higher electricity prices, come from investors of the company in the form of lower returns, or are taken from employees through fewer benefits or layoffs. That $3.6 billion does not exist in a vacuum. Although that figure might prove to be one anecdotal price point, there is more comprehensive evidence on the rising regulatory burden for the nuclear fleet.

The Mercatus Center maintains regulatory information, known as RegData, which tracks the number of “regulatory restrictions” (words like “shall” or “must”) contained in the Code of Federal Regulations (CFR). With this research tool, AAF analyzed the number of regulatory restrictions NRC imposed from 1995 to 2014. For instance, in 2005, NRC listed 11,618 restrictions, according to RegData; this grew to 16,368 by 2014, a gain of 40.8 percent. For contrast, EPA only has 3,484 restrictions in the CFR pertaining to “air pollution.” Was there a gain in 2012, the same year of the operation, maintenance, and fuel price hikes in the nuclear industry, and the same year NRC promulgated three significant new rules? Yes, an increase of 293 restrictions; the average annual gain during the sample was 250 restrictions.

There is also a correlation between Mercatus’s RegData and the increase in operation, maintenance, and fuel costs. A correlation coefficient is represented by numbers between -1 and 1, with the former representing an inverse relationship, zero representing no relationship, and 1 a significant, perfect relationship. For instance, the number of rainy days and annual average rainfall in a city would have a correlation coefficient close to 1. The relationship between RegData and nuclear operation and maintenance costs exceeds 0.9. The values are:

- 90 for operation costs;

- 91 for maintenance costs;

- 93 for combined operation and maintenance; and

- 92 for fuel spending.

Between the 2012 NRC rules, the rise in regulatory restrictions in 2012, the $3.6 billion in reported spending, and the near perfect correlation between RegData and operation, maintenance, and fuel costs, there is little doubt regulation plays a key role in driving up compliance costs in the nuclear industry.

Barriers to New Plants

Aside from the regulatory costs on the current nuclear fleet in the U.S., there are the obstacles preventing new construction as well. There is a confluence of factors that have slowed the deployment of new reactors: low natural gas prices, growing subsidies for wind and solar (but not nuclear), safety, regulatory costs, and NRC delays. However, long and expensive construction timelines don’t have to be the norm. Other nations have managed to adopt new technology far faster, and more affordably than the U.S.

Broadly, the U.S. leads the world in the number of abandoned nuclear power plant construction projects. Worldwide, companies have stopped construction on 90 reactors, but 40 of those were in the U.S. alone; the next closest country is Russia, with 12 abandoned projects. Combined, the 40 abandoned projects in the U.S. gave up more than 43 gigawatts (GW) of emission-free power (which likely could have been even larger, as existing plants have greatly increased capacity output through uprates). For perspective, the 15 largest coal-fired power plants produce about 44 GW of power. In addition to that power generation, they emit 261 million tons of carbon dioxide, or five percent of all U.S. energy-related emissions.

For a variety of reasons, construction of nuclear power in the U.S. is expensive. Even when trying to make modifications to existing plants, wait times and fees to NRC make upgrading the nation’s electricity infrastructure an expensive task. For instance, here is a brief list of uprate (increasing the power output of a reactor) approvals (in months) and fees paid to NRC to review those requests:

- Fitzpatrick Reactor: 54 months (4.5 years) and $136,934

- Nine Mile Reactor: 31 months (2.5 years) and $1.7 million

- Monticello Reactor: 60 months (5 years) and $2.3 million

- Braidwood Power Plant: 29 months (2.4 years) and $597,050

- Byron Power Plant: 29 months (2.4 years) and $632,147

Dealing with NRC review times places an incredible burden on the industry. Because time is often as precious as capital, waiting 25 years, from design, finance, regulatory approval, and construction is often prohibitive. Facing these regulatory hurdles, firms opt for less-regulated, and cheaper, forms of energy. Consider, it has taken the NRC an average of 6.7 years to approve the most recent combined construction and operation licenses and the agency is still wary of approving digital technology at reactors, instead favoring anachronistic analog functionality. In the United Kingdom, regulatory approval can be completed in roughly 4.5 years. Furthermore, the same list of wait times on uprates applies to license renewals. The uncertainty of a renewal and the long length of waiting for approval for a license extension could cause some plants to shut down prematurely rather than wait multiple years and invest million in upgrades.

Last year, a paper in Energy Policy documented the delays and costs of nuclear power generation around the world. Contrary to popular belief, the costs are not just specific to nuclear; often, they are specific to the U.S. and its approval process. The study examined “Overnight Construction Costs” (OCC) for nearly every nuclear plant in history. For the U.S., costs that were once $650 per kilowatt have escalated to roughly $11,000 per kilowatt. Between 1970 and 1978, OCC costs increased by up to 200 percent, or 5 to 15 percent annually. The authors concluded, “[O]ther duration-related issues such as licensing, regulatory delays, or back-fit requirements are a significant contributor to the rising OCC trend.” These figures might appear somewhat awkward in context, but the costs of the pending Vogtle facility in George paint a stark picture. The total cost of the project is expected to be about $14 billion, or roughly the revenues of Marriott International.

Although other western countries have witnessed similar spikes in construction costs, some nations have managed to mitigate such trends. For example, South Korean OCC costs actually declined by 13 percent for reactors constructed between 1989 and 2008. Contrast this to the U.S. experience of 50 to 200 percent increases in nuclear construction costs. This data is born out in recent construction timelines as well. The pending U.S. plants will take an average of nine years to complete. This figure is down to seven years for the South Korean plants under construction.

There are a host of reasons for these protracted construction timelines, but it’s instructive to pair them against the time it takes to build a new natural gas power plant. In some sense, this is an imperfect comparison, given the security concerns of nuclear power, but the differences are stark. In the U.S., a typical natural gas plant takes just over two years to construct. Combined with low natural gas prices, paying NRC six-to-seven-years to approve plants, and subsidies to other forms of energy, it’s easy to see why the nuclear industry is struggling, despite its sterling safety and environmental record.

Benefits

Contrary to images of radioactive waste oozing from nuclear power plants common in movies, nuclear is the safest and most environmentally-friendly power generation industry. Whether measured by overall injuries on the job, fatalities per terawatt of energy production, or overall pollution, the benefits of nuclear energy are significant.

The Bureau of Labor Statics (BLS) keeps data on both the “Incidence Rates of Nonfatal Occupational Injuries” and fatalities. Here’s a snapshot of the injury rates between nuclear, hydroelectric power, fossil fuel power, electric power transmission, and natural gas distribution.

Source: Bureau of Labor Statistics, Occupational Injuries/Illness and Fatal Injuries Profile

From 2006 to 2015, the nuclear generation industry is on average 4.7 times safer than hydroelectric power, five times safer than fossil fuel, 6.6 times safer than electric power transmission, and nearly seven times safer than natural gas distribution.

For fatalities, the picture is the same. Since 2003, BLS has recorded just one fatality for nuclear power generation, which was unrelated to radiation exposure. There have been 12 fatalities in hydroelectric power, 39 in fossil power, and 184 in electric power distribution. However, this doesn’t account for the number of power plants in each respective industry. There are hundreds of fossil fuel power plants and only 61 nuclear plants. Yet, on this count, nuclear still leads the field in safety. Per terawatt hour of electricity generation (equivalent to 1,000 gigawatts), nuclear is still the safest: 2.9 times safer than hydroelectric, 128 times safer than solar, and 131 times safer than fossil fuel power generation.

Beyond the benefits to the employees in the generation facilities, there are obvious environmental benefits when a site hardly releases any emissions. On this count, nuclear produces tremendous value. Below is a summary of biomass, coal, natural gas, nuclear, and oil electric generation facilities that produce more than 50 megawatts of power

| Fuel | Capacity Factor | Nameplate Capacity | Annual NOx Tons | Annual SO2 Tons | Annual CO2e Tons |

| Biomass | 0.49 | 98 | 175 | 456 | 43,000 |

| Coal | 0.45 | 914 | 3,818 | 8,019 | 4,056,398 |

| Natural Gas | 0.20 | 531 | 165 | 23 | 417,035 |

| Nuclear | 0.84 | 1,804 | 8 | 4 | 79 |

| Oil | 0.05 | 326 | 253 | 447 | 167,486 |

Note, nuclear’s capacity factor, essentially how often a plant produces power, is 2.8 times higher than the other energy sources. Its nameplate capacity is 3.8 times higher. However, its annual NOx emissions (a precursor to smog) are less than one percent of the fossil fuel average. Its SO2 emissions, which contribute to acid rain and haze, are also less than one percent of average. Finally, its CO2 emissions are a fraction of a percent of its energy counterparts.

In sum, whether it’s workplace injuries, fatalities, or the environmental benefits of less smog, acid rain, and fewer CO2 emissions, the benefits of nuclear power are clear. What is less certain is whether the regulation on the industry will curtail its growth and profitability to a point of obsolescence. In its place, natural gas will likely take hold or taxpayers will pay for further solar and wind deployment. Either scenario will generate environmental or fiscal costs.

NRC Reform

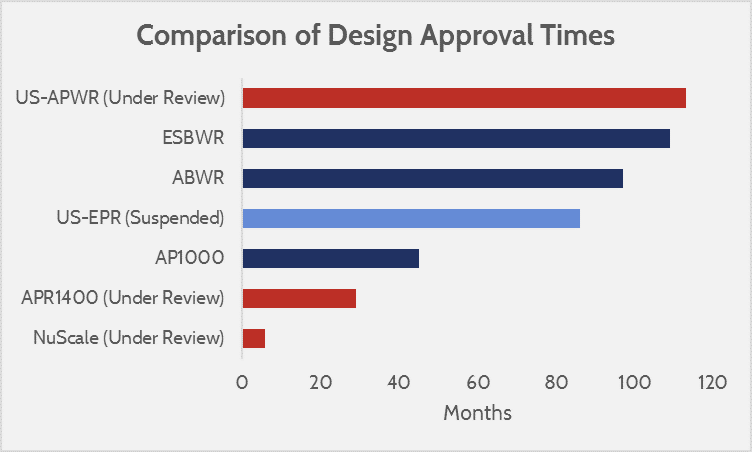

The core mission of the NRC is to ensure that nuclear power in the U.S. provides adequate safety. Ostensibly, a well-functioning regulatory authority should have lighter regulatory burdens for safer technologies, and more stringent burdens for more dangerous ones. However, the NRC’s processes and approach to regulation ensures the opposite. New power plant designs (generation III/IV) are safer than the NRC’s requirements by orders of magnitude (as measured by the probabilistic risk assessments for core damage frequency), but the approval for designs still takes several years, and that does not even include the licensing process for constructing plants after designs are approved.

To illustrate risk, below is a treemap chart showing the level of risk (expressed as core damage frequency) of a sample of new power plant designs compared to the NRC requirements and the existing nuclear fleet.

Source: IAEA and NRC technical documents of probabilistic risk assessments.[1]

In plain English, the chart below shows the probability of a core-damage event per year, and that probability relative to the NRC requirements.

| CDF per Year | Safer than NRC Requirement by a Factor of… | |

| NRC Requirement | 1 in 10,000 | N/A |

| Current Plants | 1 in 20,000 | 2 |

| US-APWR | 1 in 300,000 | 33 |

| APR1400 | 1 in 2,000,000 | 217 |

| AP600 | 1 in 5,000,000 | 588 |

| AP1000 | 1 in 60,000,000 | 6,061 |

| NuScale | 1 in 100,000,000 | 10,000 |

Despite new reactor designs being safer, reactor design approval times still take at least several years or longer (except for the AP1000, which only took 3.75 years).

Source: NRC Design Certification Applications

Although more advanced technology should, theoretically, be resulting in cheaper, safer, and more efficient nuclear technology, the strict requirements of the NRC are resulting in the opposite. Instead, nuclear technology is becoming increasingly expensive, and a drawn-out design and licensing process results in continued reliance on an aging—and less safe—nuclear fleet. It is now less clear if navigating the NRC process is helping or hurting the public good.

The NRC needs reform, but identifying specific policy changes will require testimony from nuclear experts experienced with the regulatory process and capable of identifying regulations that may be high in cost without any reduced risk (for example, analog vs. digital instrumentation). Congress has already proposed efforts to streamline nuclear technology transfer, as well as develop new regulatory guidelines for advanced nuclear plant designs, but it is uncertain yet if this will be sufficient, or if more comprehensive NRC reform will be needed to address problems that may be systemic.

Nuclear Waste

Alleviating the regulatory burdens associated with nuclear power must necessarily focus on one of the most significant regulatory liabilities of nuclear power plants: nuclear waste management. As AAF explained in its nuclear waste primer, the federal government has poorly managed the waste issue despite taking it into its jurisdiction with the Nuclear Waste Policy Act of 1982. Addressing the 75,000 metric tons of nuclear waste (mostly spent nuclear fuel rods) is a paramount concern for the nuclear industry, because the private sector’s indefinite management of nuclear waste burdens utilities with risk that is best remedied by collective action.

Nuclear waste is the greatest source of risk in nuclear power (albeit a low risk), as spent nuclear fuel is the most likely source for a radiation release. The federal government has, through law, recognized the need for a federal solution to nuclear waste, which was intended to be the federal government taking stewardship of spent nuclear fuel and storing it in a remote repository that would be paid for by a fee levied on nuclear power consumers. Essentially the private sector would fund the federal government to do what it did not have the authority to do on its own: collect and dispose of nuclear waste. Since the federal government does not have to contend with risk-averse investors, this would benefit the nuclear power industry by shifting the risk of waste management to the federal government (making nuclear power a less risky investment), and avoiding the perennial problem of finding insurers willing to cover low-probability, but high-cost nuclear disasters (the federal government acts as an insurer for major nuclear disasters). Given the security issues associated with nuclear power, it is not only the global norm but pragmatic for governments to manage nuclear waste that could potentially be weaponized (plutonium extraction, dirty bombs, etc.).

The federal government’s plan to permanently dispose of nuclear waste in a remote repository in the Nevadan desert (Yucca Mountain) was halted under President Obama in 2010. Obama was sympathetic to the concerns of Nevadans that the process for determining the nuclear waste site was unfair, and despite nearly $15 billion and decades of research spent vetting the suitability of Yucca Mountain, Obama chose to end the licensing process. His administration instead preferred a consent-based siting plan, and near the end of his term released a blueprint for how this would be conducted. However, the process between initiation and final construction for a new repository under this plan would take between 20 and 37 years, offering little relief for the nuclear industry. Nuclear waste is already piling up, meaning the most viable solution for near-term benefits is to move forward with Yucca Mountain licensing and construction. If the federal government fails to do so, it will still become liable for the waste management costs (up to $97 billion), resulting in greater costs and greater risks.

Moving forward with Yucca Mountain would benefit the nuclear industry not just by reducing the risk associated with investing in new nuclear power plants, but also in alleviating significant regulatory burdens incurred by the NRC’s oversight for nuclear power plant’s currently indefinite management of nuclear waste.

Conclusion

The nuclear power industry is by far the safest method of generating electricity in the U.S. by observable statistics from the BLS. Additionally, its extremely low pollution levels make it one of the cleanest and most plentiful electricity sources in the country. However, the regulatory regime in place does not adequately reflect the safety and environmental benefits of nuclear power. Each plant can expect to pay annually $8.6 million in regulatory costs, $22 million in NRC fees, and $32.7 million for regulatory liabilities.

The regulatory burdens on the nuclear industry are growing, and extend to significant restrictions on the licensing process for new reactors, even though they are far safer than existing nuclear plants. NuScale’s small modular reactor design is, literally, 10,000 times safer than the requirement, but is still mired in a process that does not adequately produce risk-informed regulations. Instead, newer and safer power plants struggle to comply with a regulatory regime that is designed for the power plants of the 1960s.

In addition to regulatory requirements on plants themselves, a major source of regulatory liability, as well as risk, comes from spent nuclear fuel. The federal government has also reneged on its obligation to take possession of nuclear waste, despite already taking payment from nuclear utilities. Alternative solutions to the hotly debated Yucca Mountain are so far off that they could do little to alleviate current burdens. The only option to reduce the risk and burdens of storing spent nuclear fuel at power plants is to restart the licensing process for Yucca Mountain.

The nuclear industry is struggling, but not simply because of new market forces like cheap natural gas. Its decline has been decades in the making, as the federal government has imposed increasingly onerous burdens on the industry, and failed to fulfill legal obligations to provide solutions for nuclear waste, while subsidizing competitive energy sources. The federal government has failed to adequately consider the role nuclear power plays as one of its safest and cleanest forms of energy, and the status quo promulgates a restrictive regime that stifles innovation, and steers the nation’s energy mix towards more expensive, less reliable, and dirtier sources. It is up to the federal government to sufficiently identify problems in the current regime, and implement reform at the earliest possible opportunity—lest the U.S. lose its primacy in nuclear energy and become reliant on foreign powers for innovation and expertise.

[1] https://www.iaea.org/INPRO/7th_Dialogue_Forum/2/Mitsubishi_Handout_MHI_DF7_Description_US-APWR.pdf

http://www.iaea.org/inis/collection/NCLCollectionStore/_Public/31/007/31007051.pdf

http://www.iaea.org/inis/collection/NCLCollectionStore/_Public/31/007/31007051.pdf

https://www.nrc.gov/docs/ML1333/ML13333A946.pdf

https://www.nrc.gov/docs/ML1101/ML110130034.pdf

https://aris.iaea.org/sites/..%5CPDF%5CNuScale.pdf

Scientific Notation:

| PRAs | CDF/RY |

| NRC Requirement | 1.00E-04 |

| Current Plants | 5.00E-05 |

| AP600 | 1.70E-07 |

| US-APWR | 3.00E-06 |

| APR1400 | 4.60E-07 |

| AP1000 | 1.65E-08 |

| NuScale | 1.00E-08 |