Weekly Checkup

October 5, 2016

Deductibles and Diagnosis Dates

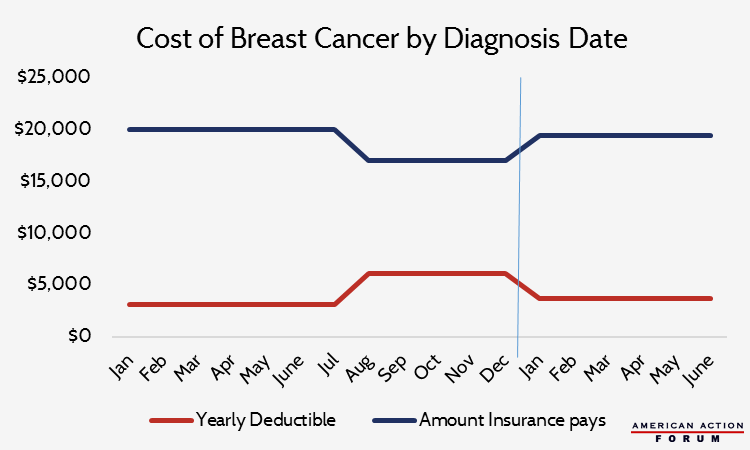

Health insurance plans operate on a calendar year, meaning that between January and December all in network health care costs that exceed a person’s yearly deductible will be paid by the insurance company. The average deductible for a Silver-level exchange plan in 2016 is $3,064. The bill to treat almost any major illness will be more than $3,000 dollars after accounting for hospitalizations, drugs and other treatments. The amount someone pays out of pocket depends on the time of year they are diagnosed. In the chart below, AAF uses a breast cancer diagnosis with 6 months of treatment to demonstrate how this works.

The initial cost to treat breast cancer is $23,078, (there may be continuing costs in addition to this). The average length of chemotherapy treatment is 3-6 months. For this analysis a 6-month treatment was used. As you can see, if someone with a Silver-level plan on the exchange is diagnosed with cancer between January and July they will only be responsible for payment of the annual deductible in the amount of $3,064. If diagnosed in the 2nd half of the year, August through December, they are responsible for two deductible payments. The first deductible paid before December 31st and the 2nd payment required January 1st of the following year. That means, assuming breast cancer is diagnosed at the same rate each month, half of all cancer patient’s costs will have doubled. In addition to the 2nd payment, deductibles will most likely increase each year. Between 2015 and 2016 deductibles increased by around 20 percent, so someone diagnosed in the second half of the year will also have this cost increase to account for when paying for treatment of their disease.